The Benefits of Being Absolutely Different

Absolute return investing is an approach which seeks to earn a positive return over time, regardless of whether markets are going up, down, or sideways — and do so with less volatility than stocks.

You may be wondering what is unique about such an approach. Don’t all investment strategies seek a positive return?

The real answer may not be what you expect.

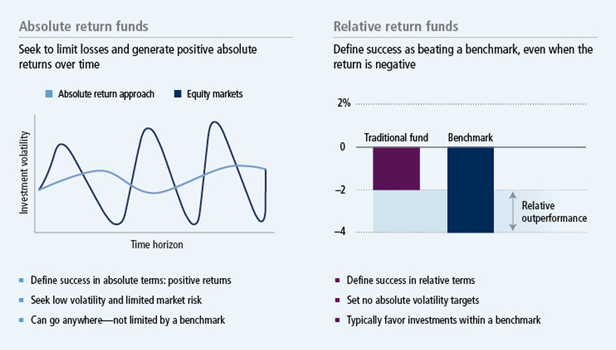

Since the introduction of benchmarks like the S&P 500 Index, most public investment funds define success in relative terms. If a fund outperforms its chosen benchmark, it is considered a success, even if the fund’s return is negative. If a fund underperforms its chosen benchmark, it is considered a failure, even if that fund has a positive return and is meeting its stated objectives. These relative return funds rarely set absolute return or volatility targets, preferring to compare their returns and volatility relative to their benchmark indexes.

Absolute return strategies take a different approach altogether. The graphic below highlights the performance goals of Absolute Return investing, contrasted with the goals of most investment funds.

The Benefits of Being Absolutely Different

By ignoring conventional benchmarks and instead striving for positive performance and lower levels of volatility, absolute return strategies can offer a number of potential benefits when added to a broadly diversified portfolio:

- Reduce overall portfolio volatility

- Limit losses during market declines

- Broaden the sources of investment returns

- Provide valuable diversification

- Improve an overall portfolio’s risk-adjusted return

One way to think about absolute return strategies is they often fill the role of the principal worrier of your overall portfolio. While other managers are thinking about what can go right with their investments and allocations, absolute return managers remain constantly on guard for what could go wrong in the markets, and they manage risk accordingly.

Absolute return managers seek individual investments and portfolio allocations which are likely to deliver a positive absolute return with reasonable volatility. Absolute return managers vary widely in the tools they use to implement their strategies. In fact, absolute return strategies are often referred to as unconstrained, because they can invest in a vast array of financial instruments — including domestic and foreign stocks, bonds, currencies, derivatives, and hedging positions.

What all absolute return strategies have in common is they generally strive for returns that have a low correlation to traditional stock and bond markets. Correlation is a statistical measure that describes how investments move in relation to each other. If two assets have a correlation of 1.0, they are said to be perfectly correlated and will generally generate returns in the same direction, and to the same magnitude. If two assets have a correlation of –1.0, they are considered negatively correlated, meaning they perform in the exact opposite direction. A correlation of zero essentially means the two assets have no performance relationship at all.

A lack of correlation can be helpful to an investor’s overall portfolio because there are times during severe market downturns when correlations rise among traditional asset categories such as stocks and bonds. The time-honored approach of mixing stocks and bonds in a portfolio for diversification is not always enough to prevent losses during all market conditions, especially when interest rates are at low levels. Having a portion of your portfolio invested in an absolute return strategy is one way to help limit overall portfolio losses — and generate gains — when nothing else is performing well.

Since 2005, our Absolute Return strategy has a near zero annual correlation with the S&P 500. Our performance has historically been uncorrelated to the broader market, which means it can offer all the benefits of being different – just when it matters most.

To request more information or schedule a consultation, visit Getting Started.

Return to Investment Management

A Visual History of the Standard 60/40 Portfolio Yield

The 20 Percent Most Investors Are Missing in Their Portfolio

The Benefits of Being Absolutely Different

Absolute return investing is an approach which seeks to earn a positive return over time, regardless of whether markets are going up, down, or sideways — and do so with less volatility than stocks.

You may be wondering what is unique about such an approach. Don’t all investment strategies seek a positive return?

The real answer may not be what you expect.

Since the introduction of benchmarks like the S&P 500 Index, most public investment funds define success in relative terms. If a fund outperforms its chosen benchmark, it is considered a success, even if the fund’s return is negative. If a fund underperforms its chosen benchmark, it is considered a failure, even if that fund has a positive return and is meeting its stated objectives. These relative return funds rarely set absolute return or volatility targets, preferring to compare their returns and volatility relative to their benchmark indexes.

Absolute return strategies take a different approach altogether. The graphic below highlights the performance goals of Absolute Return investing, contrasted with the goals of most investment funds.

The Benefits of Being Absolutely Different

By ignoring conventional benchmarks and instead striving for positive performance and lower levels of volatility, absolute return strategies can offer a number of potential benefits when added to a broadly diversified portfolio:

- Reduce overall portfolio volatility

- Limit losses during market declines

- Broaden the sources of investment returns

- Provide valuable diversification

- Improve an overall portfolio’s risk-adjusted return

One way to think about absolute return strategies is they often fill the role of the principal worrier of your overall portfolio. While other managers are thinking about what can go right with their investments and allocations, absolute return managers remain constantly on guard for what could go wrong in the markets, and they manage risk accordingly.

Absolute return managers seek individual investments and portfolio allocations which are likely to deliver a positive absolute return with reasonable volatility. Absolute return managers vary widely in the tools they use to implement their strategies. In fact, absolute return strategies are often referred to as unconstrained, because they can invest in a vast array of financial instruments — including domestic and foreign stocks, bonds, currencies, derivatives, and hedging positions.

What all absolute return strategies have in common is they generally strive for returns that have a low correlation to traditional stock and bond markets. Correlation is a statistical measure that describes how investments move in relation to each other. If two assets have a correlation of 1.0, they are said to be perfectly correlated and will generally generate returns in the same direction, and to the same magnitude. If two assets have a correlation of –1.0, they are considered negatively correlated, meaning they perform in the exact opposite direction. A correlation of zero essentially means the two assets have no performance relationship at all.

A lack of correlation can be helpful to an investor’s overall portfolio because there are times during severe market downturns when correlations rise among traditional asset categories such as stocks and bonds. The time-honored approach of mixing stocks and bonds in a portfolio for diversification is not always enough to prevent losses during all market conditions, especially when interest rates are at low levels. Having a portion of your portfolio invested in an absolute return strategy is one way to help limit overall portfolio losses — and generate gains — when nothing else is performing well.

Since 2005, our Absolute Return strategy has a near zero annual correlation with the S&P 500. Our performance has historically been uncorrelated to the broader market, which means it can offer all the benefits of being different – just when it matters most.

To request more information or schedule a consultation, visit Getting Started.

Return to Investment Management

A Visual History of the Standard 60/40 Portfolio Yield

The 20 Percent Most Investors Are Missing in Their Portfolio

Investment Management

Before investing, we will discuss your goals and risk tolerances with you to see if a separately managed account at Sitka Pacific would be a good fit. To contact us for a free consultation, visit Getting Started.

Macro Value Monitor

To read a selection of recent client letters and be alerted when new letters are posted to our public site, visit Recent Client Letters.