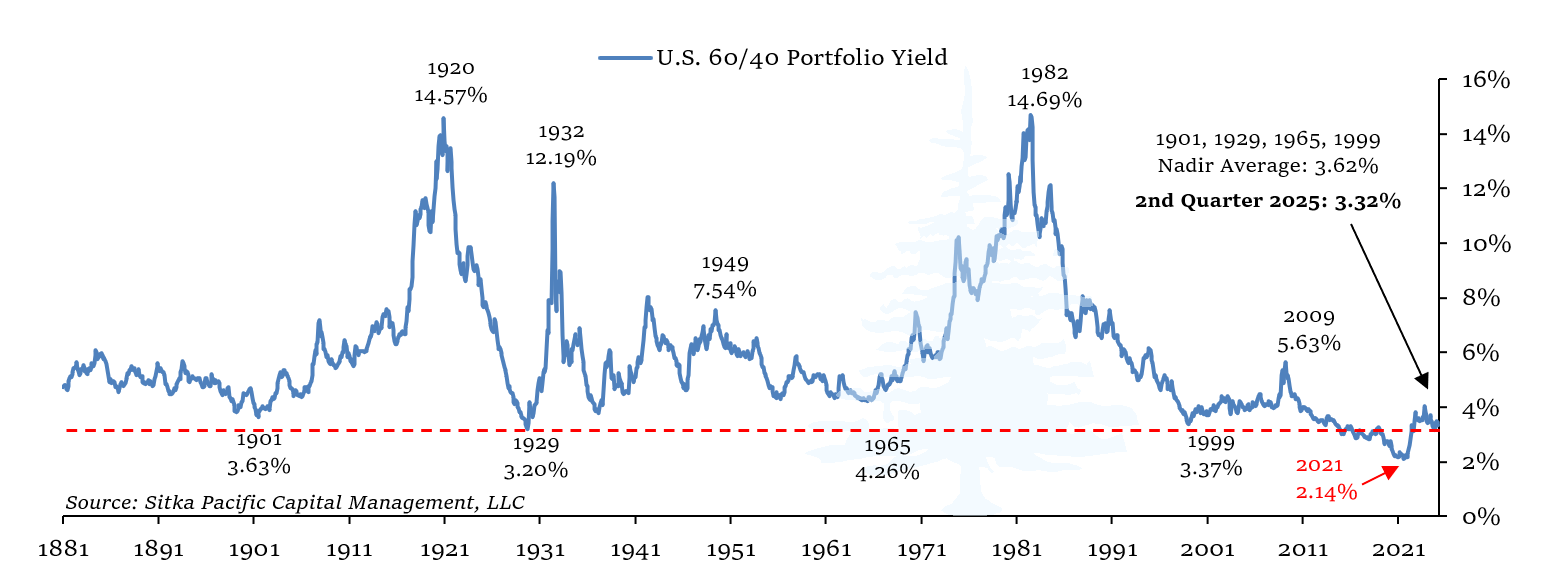

The Standard 60/40 Portfolio Yield

The current underlying yield of a standard 60/40 portfolio of U.S. stocks and bonds is shown below.

After reaching a record low of 2.14% in 2021, the underlying yield of a standard portfolio has increased to 3.47% at the start of 2025. The yield of stocks and bonds remains near prior secular low yields of the past century, recorded in 1901, 1929, 1965, and 1999. Low yields represent a dilemma for U.S. investors.

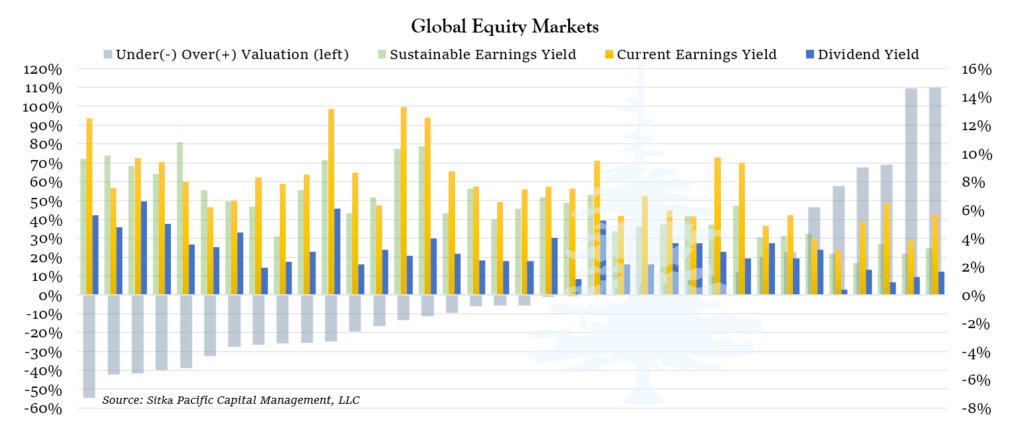

At Sitka Pacific, client portfolios are diversified among asset classes and global equity markets which represent both a good value and the opportunity for sustainable growth. Recent valuations of equity markets around the world are highlighted below.

Learn more at Investment Management.

The Standard 60/40 Portfolio Yield

The current underlying yield of a standard 60/40 portfolio of U.S. stocks and bonds is shown below.

After reaching a record low of 2.14% in 2021, the underlying yield of a standard portfolio has increased to 3.47% at the start of 2025. The yield of stocks and bonds remains near prior secular low yields of the past century, recorded in 1901, 1929, 1965, and 1999. Low yields represent a dilemma for U.S. investors.

At Sitka Pacific, client portfolios are diversified among asset classes and global equity markets which represent both a good value and the opportunity for sustainable growth. Recent valuations of equity markets around the world are highlighted below.

Learn more at Investment Management.

Investment Management

Before investing, we will discuss your goals and risk tolerances with you to see if a separately managed account at Sitka Pacific would be a good fit. To contact us for a free consultation, visit Getting Started.

Macro Value Monitor

To read a selection of recent client letters and be alerted when new letters are posted to our public site, visit Recent Client Letters.