On Resiliency, and a Solution to the 60/40 Dilemma

June 2021

In September 2013, we sent a letter to clients that began with a discussion of the Rim Fire, which had just begun blazing through the Sierra Nevada foothills in central California. The fire started when a lone hunter in a remote part of the forest above the Clavey River, several miles from the small town of Groveland (population: 601), lost control of a campfire when the wind picked up. The brush fire that ignited was only a few acres at first, but from that humble beginning it grew to 10,000 acres the following day, and by the fourth day it had exploded to 100,000 acres.

The Rim Fire caught national attention when part of the fire crossed into Yosemite National Park and threatened water quality in the Hetch Hetchy reservoir, which supplies 80% of the water for San Francisco — 160 miles to the west. At one point, more than 5000 firefighters were working to contain the flames. It ultimately consumed over 400 square miles of forestland, and due to the lack of rain that winter, it was not officially declared out until November of the following year, when the last of the smoldering logs had cooled. At the time, it was the third largest forest fire in California’s history.

While attention focused on the hunter’s errant campfire, less well known was the story of Dr. Scott Stevens, UC Berkeley’s chief fire science expert. Dr. Stevens and his team happened to be in the area when the Rim Fire ignited, where they were measuring the density of trees in the forest. His measurements showed there were up to 400 trees per acre in 2013, while there had been just 40–90 trees per acre in 1911. In other words, just before the Rim Fire ignited, the mountains were covered in a densely packed forest with five times the number of trees that had been there a century earlier.

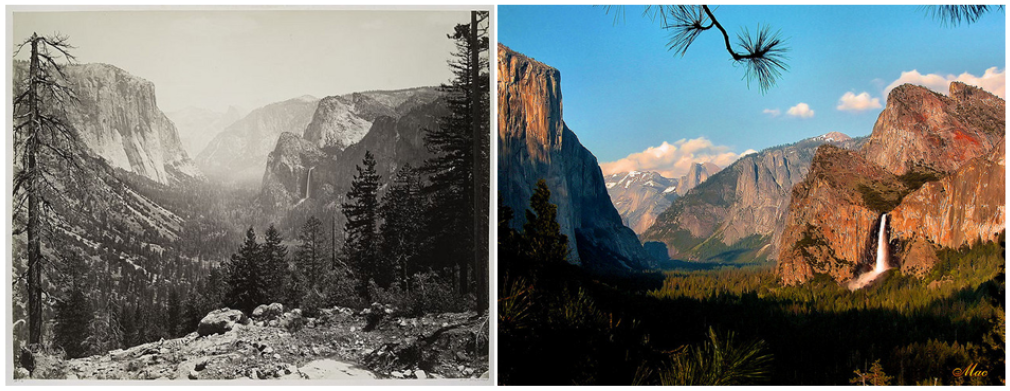

While an Overgrown Landscape Is Beautiful, It Also Represents Elevated Fire Risk

Forests and forest fires have a number of parallels with the financial markets, which is why we relate the story of the Rim Fire. Not long ago, a single fire scorching 400 square miles of land seemed almost beyond imagination. Yet since 2013, there have been seven fires in California which have exceeded the Rim Fire’s size — including one which burned over 1600 square miles.

These catastrophic firestorms were made possible, in part, due to a century of fire suppression, which allowed the forest to grow unchecked by smaller fires. The area burned by the Rim Fire had not been burned by a natural fire in more than a century, and the catastrophic fires over the last decade have highlighted just how vulnerable forests are when they are overloaded with combustible material. A lush, overgrown forest landscape may be beautiful and photogenic, but it also represents an elevated risk of fire when the right spark comes along.

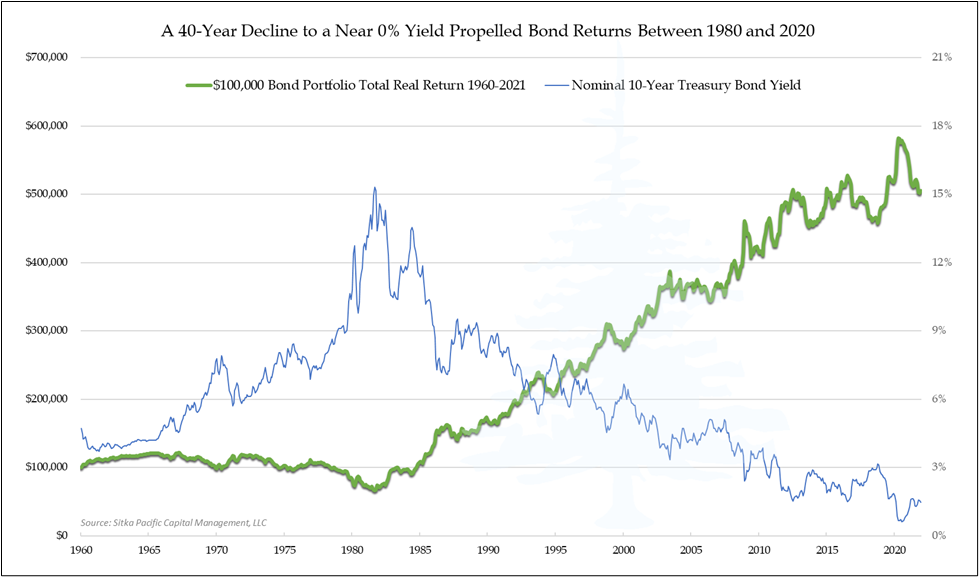

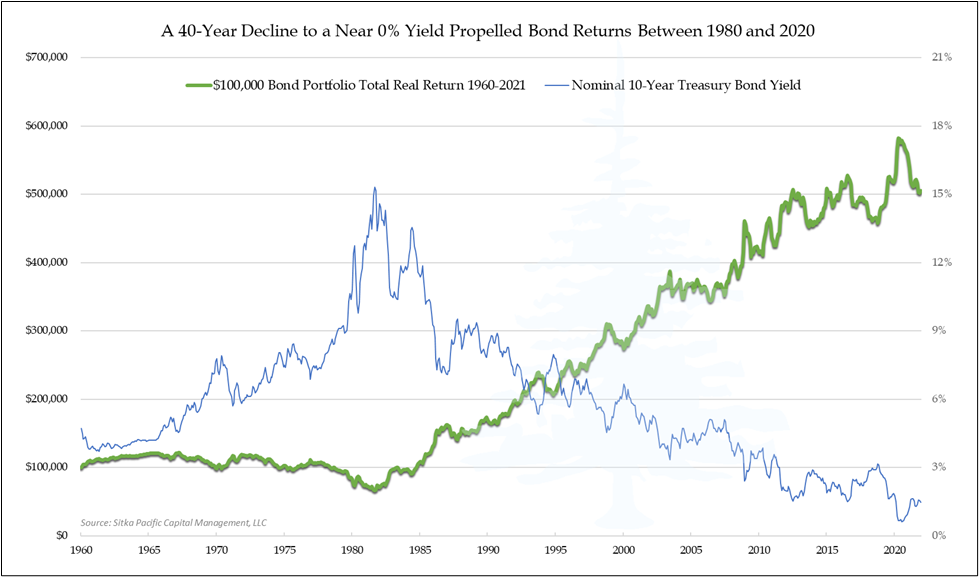

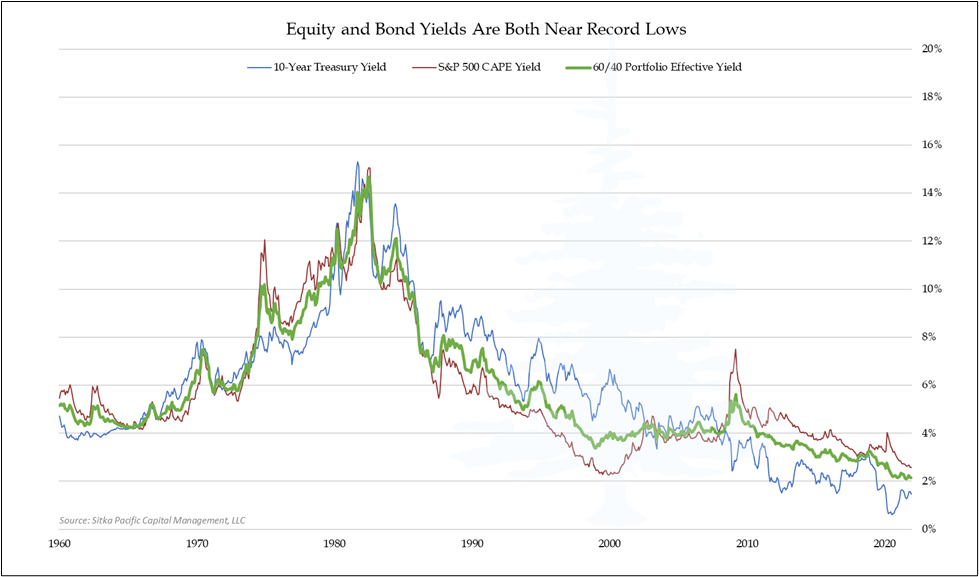

Over the last forty years, investors have experienced a truly remarkable era of nearly uninterrupted growth in U.S. financial markets, and the images of portfolio growth during those years are as beautiful as a lush forest. For investors in long-term bonds, the amazing performance of their portfolio since 1981 has resulted in a more than five-fold increase in real value. This growth was fueled by a more or less unchecked downward trend in short-term interest rates and long-term yields from the high levels of the early 1980s, with the 10-Year Treasury yield falling to just 0.4% in 2020.

Investors in bonds who reinvested interest payments over the past forty years have done exceptionally well, yet with yields having fallen to the lowest levels in history, the investment landscape is now fundamentally different. Instead of simply admiring the beauty, investors should now be asking themselves what risks are embedded in these pictures of past portfolio growth.

The 60/40 Dilemma

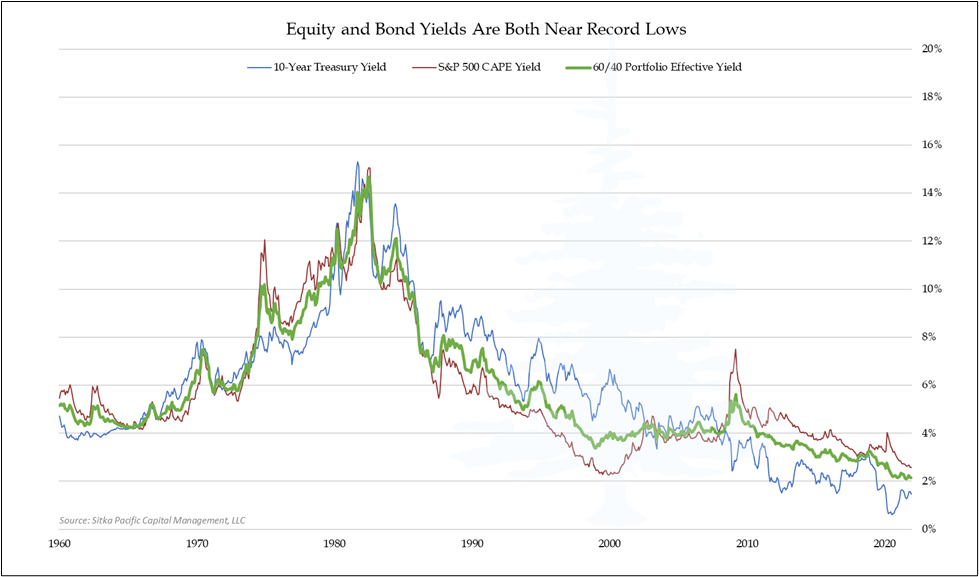

The high bond yields of the early 1980s enabled the high bond portfolio returns over the past forty years, and bond investors were not alone in benefiting from a tailwind of falling yields: investors in stocks also benefited. An investment in the S&P 500 received an earnings yield of 13% in 1981, and a downward trend in earnings yield since then coincided with a forty-year expansion in valuations.

In contrast to the early 1980s, the S&P 500 recently offered an earnings yield of less than 3%. With such ultra-low yields in stocks and bonds, the risk/reward environment today is the opposite of the early 1980s, and this poses a particularly acute dilemma for investors in the U.S. On the one hand, the benign conditions of the last forty years produced beautiful buy-and-hold returns in a standard 60/40 portfolio of stocks and bonds, but on the other hand those conditions have resulted in a severely overgrown market environment.

The effective yield of a 60/40 portfolio today is near 2%, the lowest effective yield in data going back to the 19th century, and it represents the nominal total return investors in U.S. stocks and bonds can expect in the years ahead if yields remain low. If yields do not remain low and begin to rise, total returns from passively holding a 60/40 portfolio of stocks and bonds could possibly be lower than 2%, or even negative.

The prospect of low or negative returns from passively holding stocks and bonds represents a dilemma similar to overgrown forests: the vast growth in recent decades resulted in a beautiful landscape, but there are now significant risks which were not present before. Fortunately, there is a way to address these risks: it involves a move away from the passive 60/40 portfolio of U.S. stocks and bonds to a more active, global search for investment value. This active search for investment value is the process which underlies our Absolute Return approach.

On Resiliency, and the Goals of Our Absolute Return Approach

The tailwind powering bond returns has been strong for forty years. However, in light of the decline in yields to near zero in 2020, investors should ask themselves whether bonds will be able to fulfill their traditional role of counterbalancing risk assets going forward. For bonds, it has been a long time since the last fire. When investors receive ultra-low yields from bond allocations, total returns are guaranteed to be low, and can turn negative if yields rise — exacerbating portfolio volatility, instead of dampening it. This unfavorable range of outcomes represents a fragility similar to a severely overgrown forest: a beautiful landscape embedded with hidden risks of loss.

Absolute return investing is an approach which seeks to earn a positive return over time, regardless of whether markets are going up, down or sideways — and to do so with less volatility than stocks. By ignoring conventional benchmarks and instead striving for positive absolute returns, absolute return strategies can offer a number of potential benefits to a broadly diversified equity portfolio:

- Reduce Overall Portfolio Volatility

- Limit Losses During Market Declines

- Provide Valuable Strategy Diversification

- Broaden Sources of Returns Beyond Stocks and Bonds

- Improve Overall Portfolio’s Risk-Adjusted Return

The benefits of an absolute return approach within a diversified portfolio are particularly important in today’s ultra-low yield environment. Maintaining overall portfolio resilience when risk asset yields are low is critically important, yet investors may need to incorporate more active strategies to enjoy the portfolio resilience that bonds provided in decades past.

Our Absolute Return approach serves as an effective counterbalance to risk assets using an active, absolute-value based asset allocation approach which is not dedicated to any single asset class or region. As a result, since inception our approach has had a near zero annual correlation with the S&P 500, which has helped to provide durable, long-term portfolio resilience.

If you would like to move forward with a more resilient investment portfolio that is less dependent on bonds than the traditional 60/40 portfolio, request a summary of our Absolute Return strategy at Getting Started. We would be glad to talk with you.

Return to Investment Management

Read a Selection of Recent Memos, Articles and Client Letters

The content of this article is provided as general information and is for educational purposes only. It is not intended to provide investment or other advice. This material is not to be construed as a recommendation or solicitation to buy or sell any security, financial product, instrument or to participate in any particular trading strategy. Not all securities, products or services described are available in all countries, and nothing herein constitutes an offer or solicitation of any securities, products or services in any jurisdiction where their offer or sale is not qualified or exempt from registration or otherwise legally permissible.

Although the material herein is based upon information considered reliable and up-to-date, Sitka Pacific Capital Management, LLC does not assure that this material is accurate, current, or complete, and it should not be relied upon as such. Content in this document may not be copied, reproduced, republished, or posted, in whole or in part, without prior written consent — which is usually gladly given, as long as its use includes clear and proper attribution. Contact us for more information.

© Sitka Pacific Capital Management, LLC

On Resiliency, and a Solution to the 60/40 Dilemma

June 2021

In September 2013, we sent a letter to clients that began with a discussion of the Rim Fire, which had just begun blazing through the Sierra Nevada foothills in central California. The fire started when a lone hunter in a remote part of the forest above the Clavey River, several miles from the small town of Groveland (population: 601), lost control of a campfire when the wind picked up. The brush fire that ignited was only a few acres at first, but from that humble beginning it grew to 10,000 acres the following day, and by the fourth day it had exploded to 100,000 acres.

The Rim Fire caught national attention when part of the fire crossed into Yosemite National Park and threatened water quality in the Hetch Hetchy reservoir, which supplies 80% of the water for San Francisco — 160 miles to the west. At one point, more than 5000 firefighters were working to contain the flames. It ultimately consumed over 400 square miles of forestland, and due to the lack of rain that winter, it was not officially declared out until November of the following year, when the last of the smoldering logs had cooled. At the time, it was the third largest forest fire in California’s history.

While attention focused on the hunter’s errant campfire, less well known was the story of Dr. Scott Stevens, UC Berkeley’s chief fire science expert. Dr. Stevens and his team happened to be in the area when the Rim Fire ignited, where they were measuring the density of trees in the forest. His measurements showed there were up to 400 trees per acre in 2013, while there had been just 40–90 trees per acre in 1911. In other words, just before the Rim Fire ignited, the mountains were covered in a densely packed forest with five times the number of trees that had been there a century earlier.

While an Overgrown Landscape Is Beautiful, It Also Represents Elevated Fire Risk

Forests and forest fires have a number of parallels with the financial markets, which is why we relate the story of the Rim Fire. Not long ago, a single fire scorching 400 square miles of land seemed almost beyond imagination. Yet since 2013, there have been seven fires in California which have exceeded the Rim Fire’s size — including one which burned over 1600 square miles.

These catastrophic firestorms were made possible, in part, due to a century of fire suppression, which allowed the forest to grow unchecked by smaller fires. The area burned by the Rim Fire had not been burned by a natural fire in more than a century, and the catastrophic fires over the last decade have highlighted just how vulnerable forests are when they are overloaded with combustible material. A lush, overgrown forest landscape may be beautiful and photogenic, but it also represents an elevated risk of fire when the right spark comes along.

Over the last forty years, investors have experienced a truly remarkable era of nearly uninterrupted growth in U.S. financial markets, and the images of portfolio growth during those years are as beautiful as a lush forest. For investors in long-term bonds, the amazing performance of their portfolio since 1981 has resulted in a more than five-fold increase in real value. This growth was fueled by a more or less unchecked downward trend in short-term interest rates and long-term yields from the high levels of the early 1980s, with the 10-Year Treasury yield falling to just 0.4% in 2020.

Investors in bonds who reinvested interest payments over the past forty years have done exceptionally well, yet with yields having fallen to the lowest levels in history, the investment landscape is now fundamentally different. Instead of simply admiring the beauty, investors should now be asking themselves what risks are embedded in these pictures of past portfolio growth.

The 60/40 Dilemma

The high bond yields of the early 1980s enabled the high bond portfolio returns over the past forty years, and bond investors were not alone in benefiting from a tailwind of falling yields: investors in stocks also benefited. An investment in the S&P 500 received an earnings yield of 13% in 1981, and a downward trend in earnings yield since then coincided with a forty-year expansion in valuations.

In contrast to the early 1980s, the S&P 500 recently offered an earnings yield of less than 3%. With such ultra-low yields in stocks and bonds, the risk/reward environment today is the opposite of the early 1980s, and this poses a particularly acute dilemma for investors in the U.S. On the one hand, the benign conditions of the last forty years produced beautiful buy-and-hold returns in a standard 60/40 portfolio of stocks and bonds, but on the other hand those conditions have resulted in a severely overgrown market environment.

The effective yield of a 60/40 portfolio today is near 2%, the lowest effective yield in data going back to the 19th century, and it represents the nominal total return investors in U.S. stocks and bonds can expect in the years ahead if yields remain low. If yields do not remain low and begin to rise, total returns from passively holding a 60/40 portfolio of stocks and bonds could possibly be lower than 2%, or even negative.

The prospect of low or negative returns from passively holding stocks and bonds represents a dilemma similar to overgrown forests: the vast growth in recent decades resulted in a beautiful landscape, but there are now significant risks which were not present before. Fortunately, there is a way to address these risks: it involves a move away from the passive 60/40 portfolio of U.S. stocks and bonds to a more active, global search for investment value. This active search for investment value is the process which underlies our Absolute Return approach.

On Resiliency, and the Goals of Our Absolute Return Approach

The tailwind powering bond returns has been strong for forty years. However, in light of the decline in yields to near zero in 2020, investors should ask themselves whether bonds will be able to fulfill their traditional role of counterbalancing risk assets going forward. For bonds, it has been a long time since the last fire. When investors receive ultra-low yields from bond allocations, total returns are guaranteed to be low, and can turn negative if yields rise — exacerbating portfolio volatility, instead of dampening it. This unfavorable range of outcomes represents a fragility similar to a severely overgrown forest: a beautiful landscape embedded with hidden risks of loss.

Absolute return investing is an approach which seeks to earn a positive return over time, regardless of whether markets are going up, down or sideways — and to do so with less volatility than stocks. By ignoring conventional benchmarks and instead striving for positive absolute returns, absolute return strategies can offer a number of potential benefits to a broadly diversified equity portfolio:

- Reduce Overall Portfolio Volatility

- Limit Losses During Market Declines

- Provide Valuable Strategy Diversification

- Broaden Sources of Returns Beyond Stocks and Bonds

- Improve Overall Portfolio’s Risk-Adjusted Return

The benefits of an absolute return approach within a diversified portfolio are particularly important in today’s ultra-low yield environment. Maintaining overall portfolio resilience when risk asset yields are low is critically important, yet investors may need to incorporate more active strategies to enjoy the portfolio resilience that bonds provided in decades past.

Our Absolute Return approach serves as an effective counterbalance to risk assets using an active, absolute-value based asset allocation approach which is not dedicated to any single asset class or region. As a result, since inception our approach has had a near zero annual correlation with the S&P 500, which has helped to provide durable, long-term portfolio resilience.

If you would like to move forward with a more resilient investment portfolio that is less dependent on bonds than the traditional 60/40 portfolio, request a summary of our Absolute Return strategy at Getting Started. We would be glad to talk with you.

Return to Investment Management

Read a Selection of Recent Memos, Articles and Client Letters

The content of this article is provided as general information and is for educational purposes only. It is not intended to provide investment or other advice. This material is not to be construed as a recommendation or solicitation to buy or sell any security, financial product, instrument or to participate in any particular trading strategy. Not all securities, products or services described are available in all countries, and nothing herein constitutes an offer or solicitation of any securities, products or services in any jurisdiction where their offer or sale is not qualified or exempt from registration or otherwise legally permissible.

Although the material herein is based upon information considered reliable and up-to-date, Sitka Pacific Capital Management, LLC does not assure that this material is accurate, current, or complete, and it should not be relied upon as such. Content in this document may not be copied, reproduced, republished, or posted, in whole or in part, without prior written consent — which is usually gladly given, as long as its use includes clear and proper attribution. Contact us for more information.

© Sitka Pacific Capital Management, LLC

Investment Management

Before investing, we will discuss your goals and risk tolerances with you to see if a separately managed account at Sitka Pacific would be a good fit. To contact us for a free consultation, visit Getting Started.

Macro Value Monitor

To read a selection of recent client letters and be alerted when new letters are posted to our public site, visit Recent Client Letters.