The 20 Percent Most Investors Are Missing in Their Portfolio

October 2022 Memo

If the past year has felt like a difficult period in the markets, you are certainly not alone.

The arrival of the first bout of persistent inflation in four decades has transformed the market landscape, and in doing so it has challenged many principles long considered to be ironclad laws of investing by generations of investors. There has not been a more significant transition in the markets since the early 1980s.

In the wake of this inflationary transition, individual and professional investors have been questioning their approach to the markets, and rethinking many of their planning assumptions – and they are right to do so. In many cases, investment strategies which were reliable when inflation was stable have been revealed to be surprisingly fragile when inflation unexpectedly rose. Assessing whether an approach will recover its footing or will continue to be fragile and loss-prone is an exercise every investor should be undertaking right now.

However, in conversations throughout this year, I’ve observed many investors are not asking a question they should be asking. Instead of asking whether they should have more in stocks, or more in bonds, or perhaps less in both and more in cash, investors should be asking whether there are asset classes beyond stocks and bonds that should be incorporated into their portfolio to keep them on track?

The answer to that question is an emphatic yes, as will be shown below.

In June 2021, I published this memo, which detailed the record low yield a portfolio of stocks and bonds was providing investors. At the time, the record low yield was a risk that few investors were paying attention to as inflation rates began to rise. The risk was that if inflation rates continued to rise, the yield of stocks and bonds would eventually rise as well, and a new trend of rising yields would likely result in large losses to investors.

Since that memo was published, the combined losses in stocks and bonds have been the largest in more than half a century. The national debate throughout this hostile devaluation has been centered around how high inflation rates may go, how long elevated inflation will last, and how high interest rates will be increased in response. The answers to these questions are critical for investors in stocks and bonds, as a recovery in their portfolio is dependent on inflation subsiding.

Yet for investors who look beyond stocks and bonds, the outcome of the current bout of inflation is less critical for their overall portfolio. These investors know that even during the long periods when inflation ravaged investment portfolios in the past, as it did between 1970 and 1982, a portfolio which remained diversified beyond stocks and bonds still provided growth.

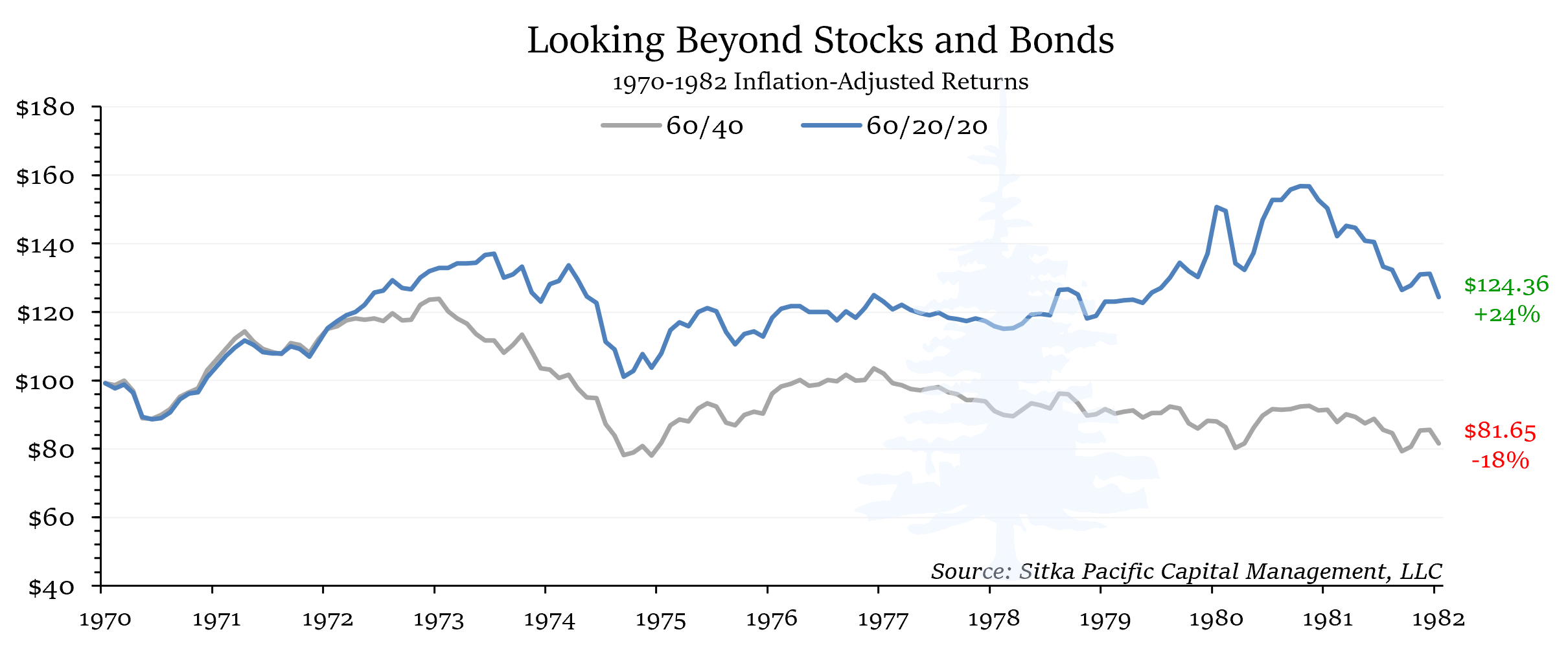

The chart below shows that a portfolio which maintained 20% in assets outside stocks and bonds between 1970 and 1982 outperformed a standard 60/40 portfolio by a staggering 42%. As inflation rates rose to the highest levels in modern history, this critical 20% allocation outside stocks and bonds proved to be the difference between a portfolio which continued growing and a portfolio which steadily eroded value.

Investors who have looked beyond stocks and bonds also understand that diversifying 20% of their portfolio not only provides higher, more stable growth during periods of rising inflation, it also provides growth during difficult market conditions that are not inflationary.

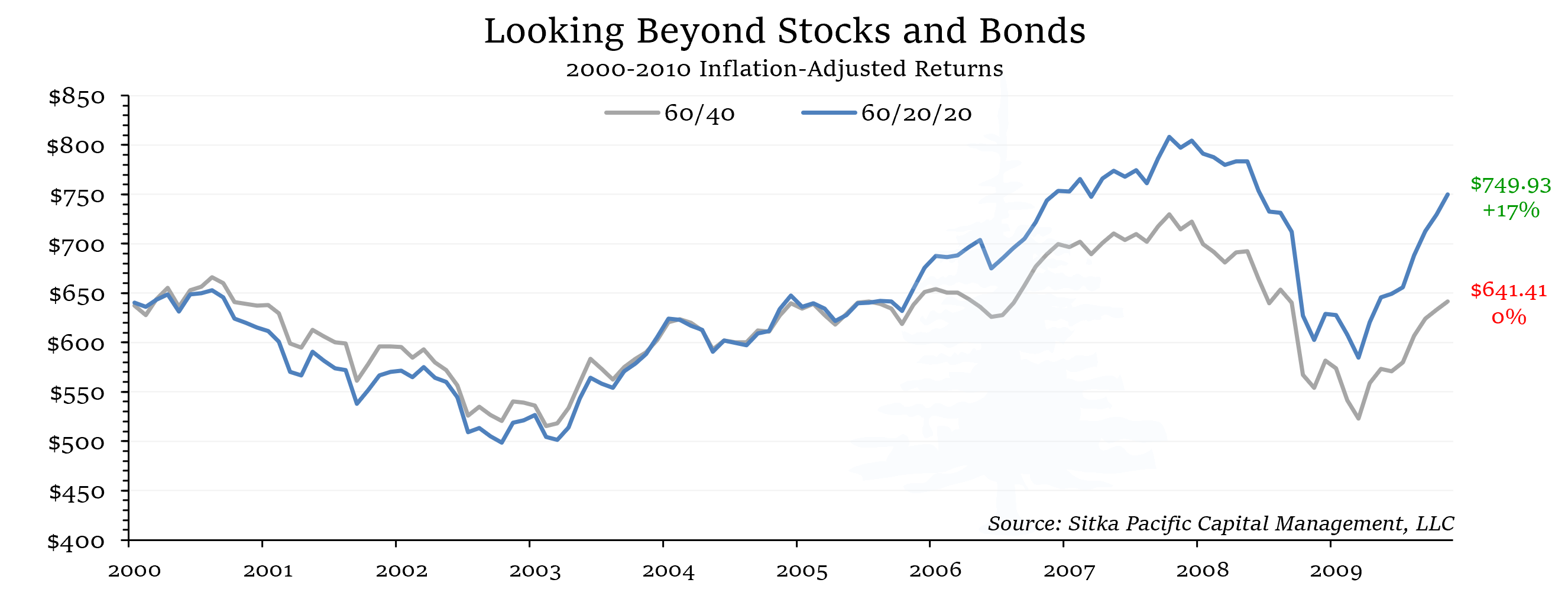

In the decade after the tech bubble burst in 2000, a 60/40 portfolio of stocks and bonds delivered a 0% return, after inflation. In other words, the years between 2000 and 2010 proved to be a lost decade for portfolio returns.

Yet for those who maintained 20% of their portfolio outside stocks and bonds, the most turbulent decade since the Great Depression still ended with portfolio gains. While a 60/40 portfolio delivered a 0% return between 2000 and 2010, investors who maintained 20% of their portfolio outside stocks and bonds during the Tech Bust and the Credit Crisis realized a 17% gain.

As was the case for investors in the inflationary 1970s, investors in the disinflationary 2000s benefited significantly by maintaining 20% of their portfolios outside stocks and bonds. Their portfolios continued to grow while the traditional 60/40 portfolio stagnated.

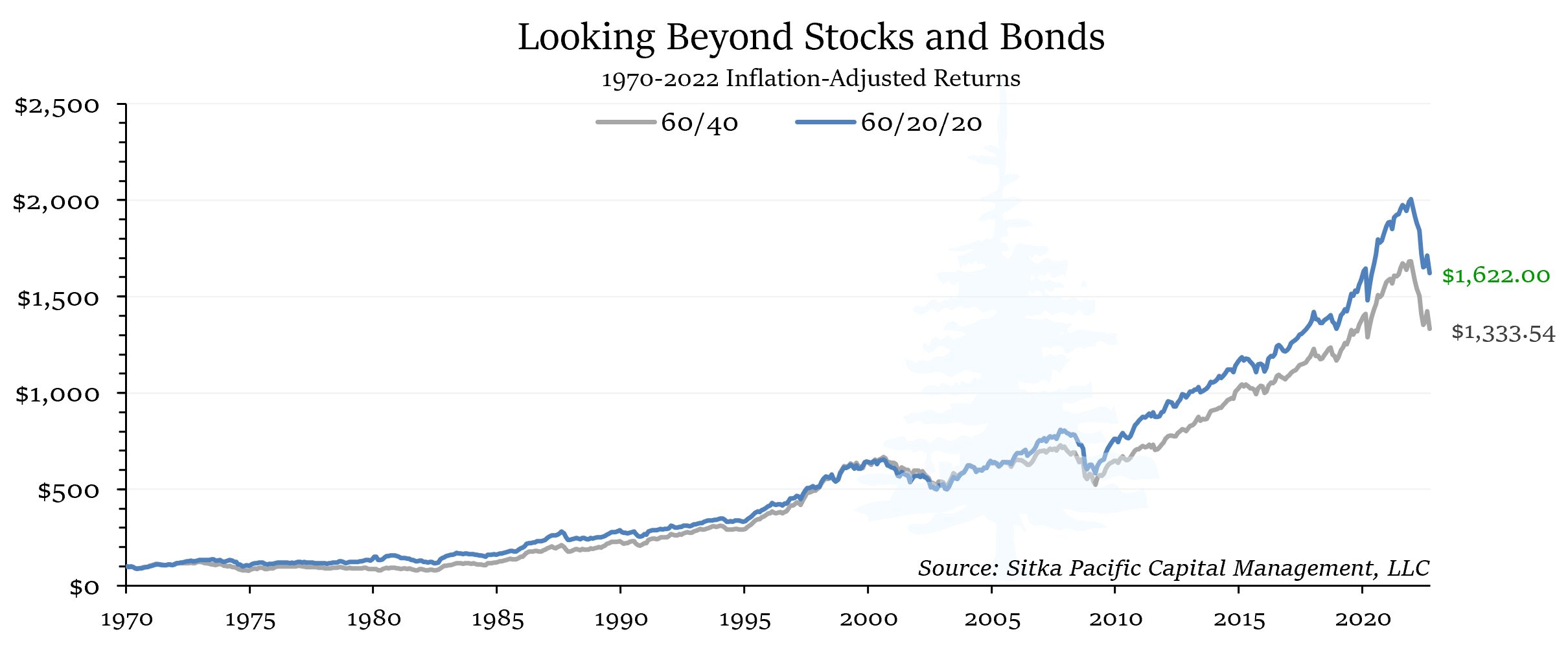

Most importantly, diversifying 20% of a portfolio outside stocks and bonds not only helps provide returns during periods of rising inflation and bursting bubbles – it helps provide a greater long-term return as well. As you can see in the chart below, investors who look beyond stocks and bonds do not give up long-term performance in exchange for protection from rising inflation or long equity market declines – they gain from the diversification in the short run and the long run.

As the debate over inflation continues, and investors continue to guess the likely impact of rising interest rates on their portfolio, investors who have already made the transition to a 60/20/20 portfolio understand that their portfolio will likely perform better over time, regardless if inflation persists or not. That is a comforting thought.

If you would like to move forward with a more resilient portfolio that is less dependent on the outlook for inflation, interest rates, or the economy, visit Getting Started to schedule a review of your portfolio. We would be happy to partner with you to implement a more resilient, all-weather investment management plan.

Sincerely,

Brian McAuley

Founder and Principal Advisor

Sitka Pacific Capital Management, LLC

Return to Investment Management

Read a Selection of Recent Memos, Articles and Client Letters

The content of this article is provided as general information and is for educational purposes only. It is not intended to provide investment or other advice. This material is not to be construed as a recommendation or solicitation to buy or sell any security, financial product, instrument or to participate in any particular trading strategy. Not all securities, products or services described are available in all countries, and nothing herein constitutes an offer or solicitation of any securities, products or services in any jurisdiction where their offer or sale is not qualified or exempt from registration or otherwise legally permissible.

Although the material herein is based upon information considered reliable and up-to-date, Sitka Pacific Capital Management, LLC does not assure that this material is accurate, current, or complete, and it should not be relied upon as such. Content in this document may not be copied, reproduced, republished, or posted, in whole or in part, without prior written consent — which is usually gladly given, as long as its use includes clear and proper attribution. Contact us for more information.

© Sitka Pacific Capital Management, LLC

The 20 Percent Most Investors Are Missing in Their Portfolio

October 2022 Memo

If the past year has felt like a difficult period in the markets, you are certainly not alone.

The arrival of the first bout of persistent inflation in four decades has transformed the market landscape, and in doing so it has challenged many principles long considered to be ironclad laws of investing by generations of investors. There has not been a more significant transition in the markets since the early 1980s.

In the wake of this inflationary transition, individual and professional investors have been questioning their approach to the markets, and rethinking many of their planning assumptions – and they are right to do so. In many cases, investment strategies which were reliable when inflation was stable have been revealed to be surprisingly fragile when inflation unexpectedly rose. Assessing whether an approach will recover its footing or will continue to be fragile and loss-prone is an exercise every investor should be undertaking right now.

However, in conversations throughout this year, I’ve observed many investors are not asking a question they should be asking. Instead of asking whether they should have more in stocks, or more in bonds, or perhaps less in both and more in cash, investors should be asking whether there are asset classes beyond stocks and bonds that should be incorporated into their portfolio to keep them on track?

The answer to that question is an emphatic yes, as will be shown below.

In June 2021, I published this memo, which detailed the record low yield a portfolio of stocks and bonds was providing investors. At the time, the record low yield was a risk that few investors were paying attention to as inflation rates began to rise. The risk was that if inflation rates continued to rise, the yield of stocks and bonds would eventually rise as well, and a new trend of rising yields would likely result in large losses to investors.

Since that memo was published, the combined losses in stocks and bonds have been the largest in more than half a century. The national debate throughout this hostile devaluation has been centered around how high inflation rates may go, how long elevated inflation will last, and how high interest rates will be increased in response. The answers to these questions are critical for investors in stocks and bonds, as a recovery in their portfolio is dependent on inflation subsiding.

Yet for investors who look beyond stocks and bonds, the outcome of the current bout of inflation is less critical for their overall portfolio. These investors know that even during the long periods when inflation ravaged investment portfolios in the past, as it did between 1970 and 1982, a portfolio which remained diversified beyond stocks and bonds still provided growth.

The chart below shows that a portfolio which maintained 20% in assets outside stocks and bonds between 1970 and 1982 outperformed a standard 60/40 portfolio by a staggering 42%. As inflation rates rose to the highest levels in modern history, this critical 20% allocation outside stocks and bonds proved to be the difference between a portfolio which continued growing and a portfolio which steadily eroded value.

Investors who have looked beyond stocks and bonds also understand that diversifying 20% of their portfolio not only provides higher, more stable growth during periods of rising inflation, it also provides growth during difficult market conditions that are not inflationary.

In the decade after the tech bubble burst in 2000, a 60/40 portfolio of stocks and bonds delivered a 0% return, after inflation. In other words, the years between 2000 and 2010 proved to be a lost decade for portfolio returns.

Yet for those who maintained 20% of their portfolio outside stocks and bonds, the most turbulent decade since the Great Depression still ended with portfolio gains. While a 60/40 portfolio delivered a 0% return between 2000 and 2010, investors who maintained 20% of their portfolio outside stocks and bonds during the Tech Bust and the Credit Crisis realized a 17% gain.

As was the case for investors in the inflationary 1970s, investors in the disinflationary 2000s benefited significantly by maintaining 20% of their portfolios outside stocks and bonds. Their portfolios continued to grow while the traditional 60/40 portfolio stagnated.

Most importantly, diversifying 20% of a portfolio outside stocks and bonds not only helps provide returns during periods of rising inflation and bursting bubbles – it helps provide a greater long-term return as well. As you can see in the chart below, investors who look beyond stocks and bonds do not give up long-term performance in exchange for protection from rising inflation or long equity market declines – they gain from the diversification in the short run and the long run.

As the debate over inflation continues, and investors continue to guess the likely impact of rising interest rates on their portfolio, investors who have already made the transition to a 60/20/20 portfolio understand that their portfolio will likely perform better over time, regardless if inflation persists or not. That is a comforting thought.

If you would like to move forward with a more resilient portfolio that is less dependent on the outlook for inflation, interest rates, or the economy, visit Getting Started to schedule a review of your portfolio. We would be happy to partner with you to implement a more resilient, all-weather investment management plan.

Sincerely,

Brian McAuley

Founder and Principal Advisor

Sitka Pacific Capital Management, LLC

Return to Investment Management

Read a Selection of Recent Memos, Articles and Client Letters

The content of this article is provided as general information and is for educational purposes only. It is not intended to provide investment or other advice. This material is not to be construed as a recommendation or solicitation to buy or sell any security, financial product, instrument or to participate in any particular trading strategy. Not all securities, products or services described are available in all countries, and nothing herein constitutes an offer or solicitation of any securities, products or services in any jurisdiction where their offer or sale is not qualified or exempt from registration or otherwise legally permissible.

Although the material herein is based upon information considered reliable and up-to-date, Sitka Pacific Capital Management, LLC does not assure that this material is accurate, current, or complete, and it should not be relied upon as such. Content in this document may not be copied, reproduced, republished, or posted, in whole or in part, without prior written consent — which is usually gladly given, as long as its use includes clear and proper attribution. Contact us for more information.

© Sitka Pacific Capital Management, LLC

Investment Management

Before investing, we will discuss your goals and risk tolerances with you to see if a separately managed account at Sitka Pacific would be a good fit. To contact us for a free consultation, visit Getting Started.

Macro Value Monitor

To read a selection of recent client letters and be alerted when new letters are posted to our public site, visit Recent Client Letters.