Intelligent Investing Finally Returned in 2022

April 2023 Memo

Every crisis features human actors, and they always seem to step on the same rakes. They overlend and they overborrow; they get bullish at the top, and then, wouldn’t you know it, they get bearish at the bottom. The longer I live, the more I see that human beings have no business dealing with money. They are genetically unequipped for it, and it’s a wonder that anybody’s solvent.

Then again, no two crises are exactly the same. Except for the differences, after all, the historians would have all the money…

~ Jim Grant, of Grant’s Interest Rate Observer, April 16, 2009

For those of us with an inclination toward understanding current events through the lens of history, periods of irrational exuberance represent a special challenge.

On the one hand, periods of irrational exuberance have occurred so often throughout history, with such fascinating similarity, that they naturally make market historians pre-disposed toward skepticism. This skepticism flows from a keen awareness of the tremendous impact of the inevitable fallout once the exuberance comes to an end.

Yet on the other hand, history often rhymes, but it does not repeat. This makes navigating the aftermath of a period of irrational exuberance an existential challenge, because each period is unique. As investors, we must respond to market trends as they actually unfold – not as history says they should unfold.

Where an awareness of history comes in most handy is in understanding the features of booms and busts which nearly all periods of speculative fervor share. This can provide an awareness that it most likely is not different this time, while also helping avoid critical errors that are made when it is assumed contemporary events will play out just as the past did.

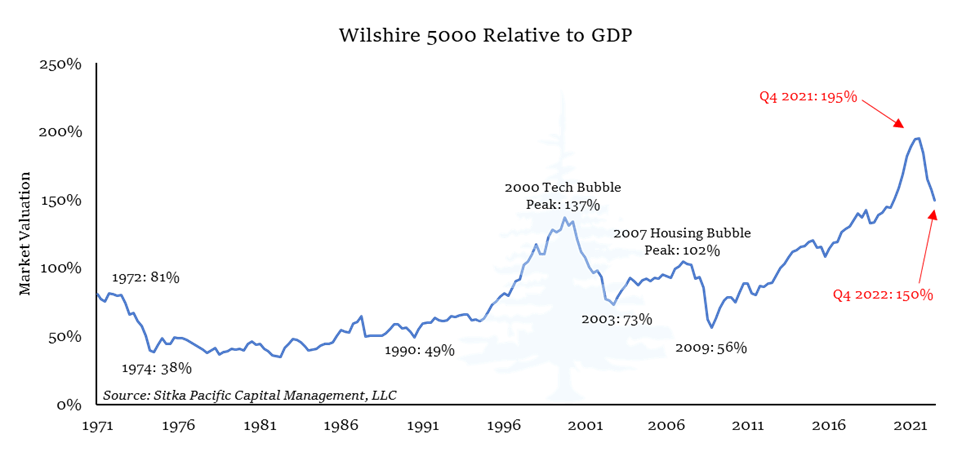

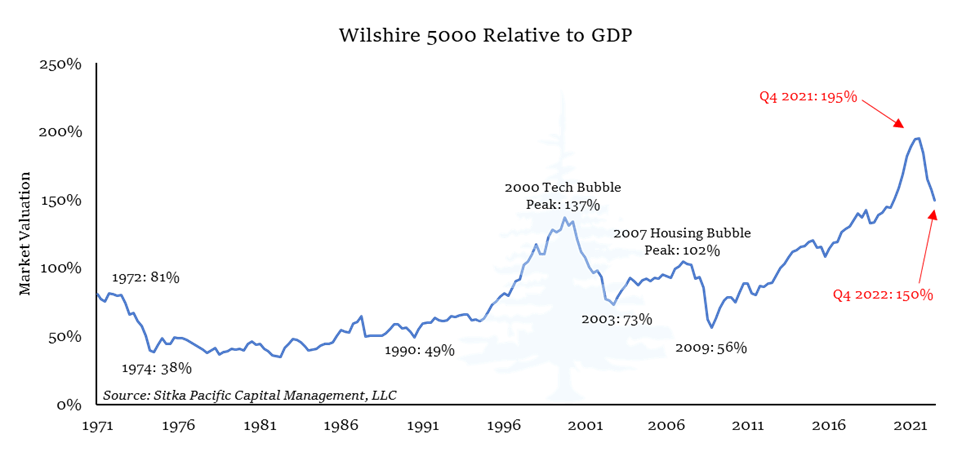

The following charts highlight what the global equity market landscape looked like in 2021 and 2022, which will live in infamy as one of the most exuberant market environments in history.

The chart above shows that the value of the Wilshire 5000 Index reached 195% of Gross Domestic Product (GDP) in late 2021, just before the market turned down in 2022. This unprecedented valuation in 2021 left stocks in the U.S. valued at close to twice the size of the economy, and it was 42% higher than in 2000, at the peak of the Tech Bubble.

As I discussed in letters and articles throughout 2021 and 2022, the market environment leading up to that peak valuation was as exuberant as any other period in history. The next chart highlights that exuberance in action.

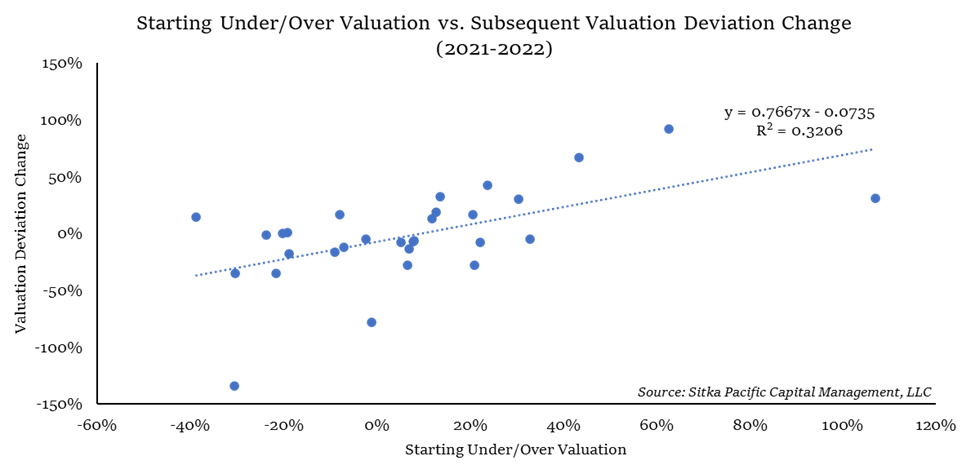

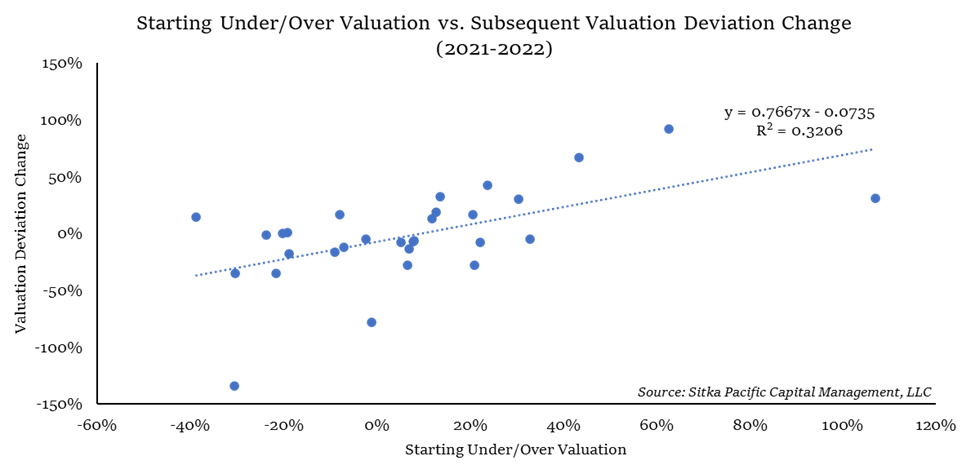

Each dot below represents one global equity market, except the U.S. market is broken down into two separate dots representing small-cap and large-stocks; those two dots are furthermost on the right of the chart, which indicates that small and large-cap stocks were alone in being severely overvalued in 2021.

The rest of the world’s equity markets are clustered on the left side of the chart, to the right and left of “0%” on the horizontal axis. This indicates markets outside the U.S. were, as a group, fairly valued to begin 2021.

The upward sloping dashed regression line shows that the more overvalued a market was in early 2021, the higher return it provided over the subsequent year. And the more undervalued a market was, the lower its return tended to be in 2021.

This behavior is the opposite of what is generally expected by intelligent investing, as the grandfather of value investing Benjamin Graham outlined it. The central idea when looking at market prices from an intelligent, value perspective is that the lower the valuation of an investment, the higher the subsequent return will be.

Yet in 2021, and the years leading up to 2021, the opposite was the case. In those years, there was a positive correlation between valuation and return. In other words, the higher the valuation climbed, the higher the subsequent return.

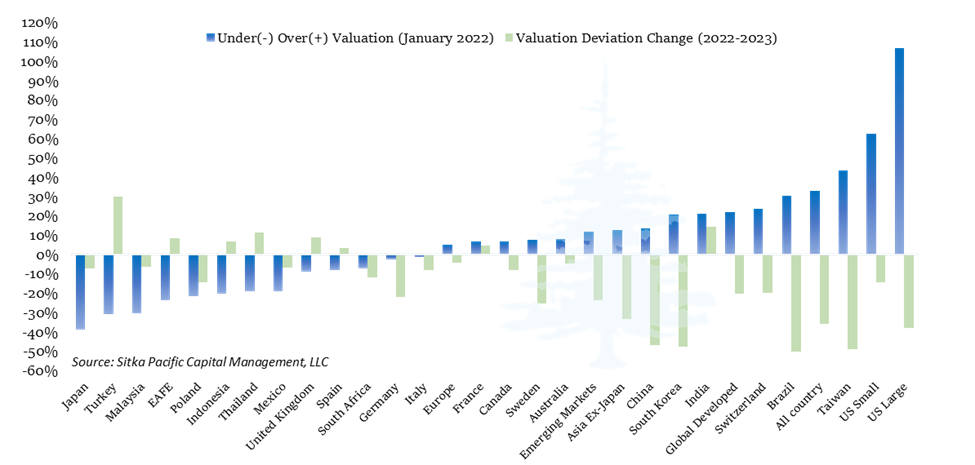

Then in 2022, it all changed, and the markets finally began to act more intelligently: overvalued equity markets began to decline, and undervalued equity markets generally maintained their valuation, or increased value, as one would expect:

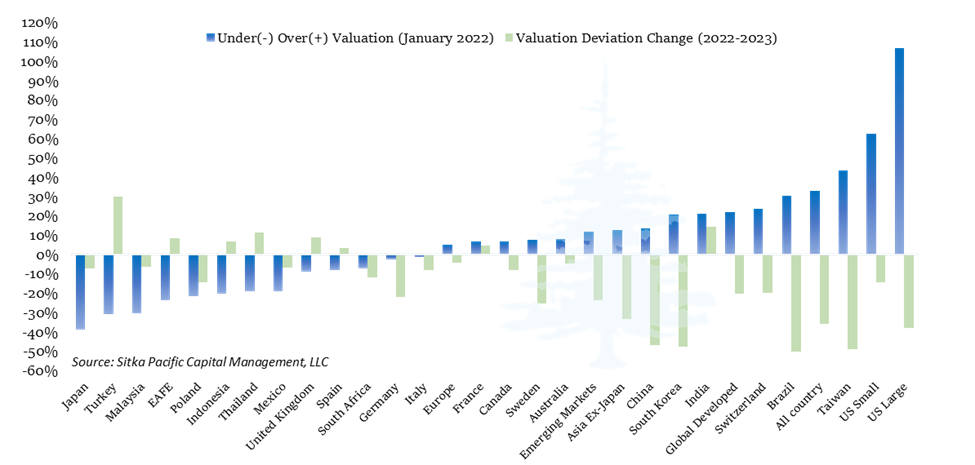

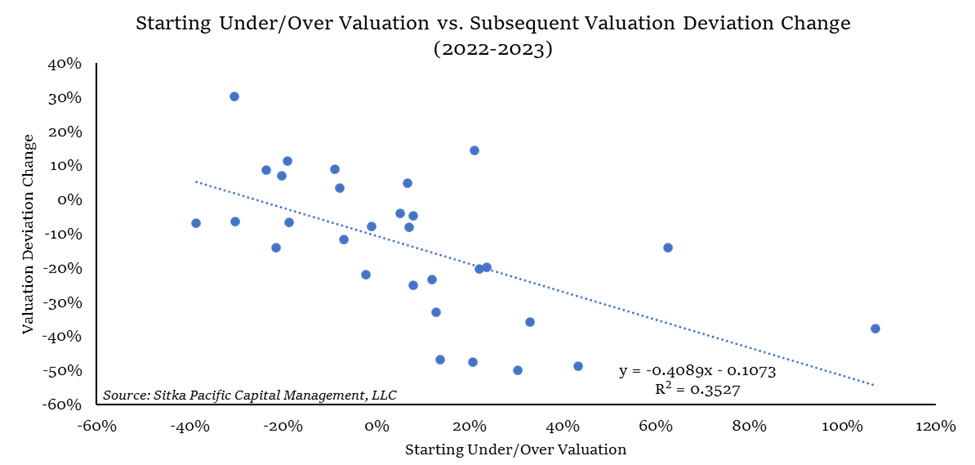

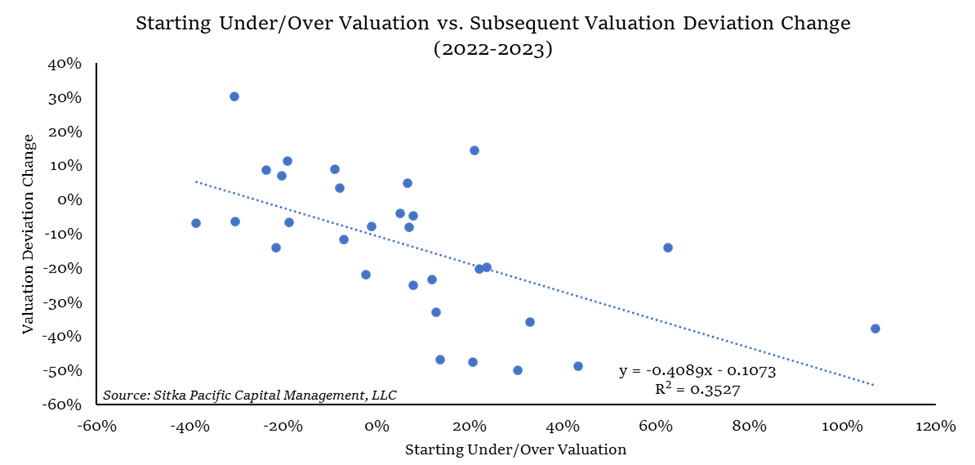

The return of intelligent investing in 2022 reversed the relationship between valuation and subsequent returns from what it had been in prior years. This can be seen in the chart below, with the dashed regression line between valuation and subsequent return sloping strongly downward in 2022. This reflects the expected long-term relationship between valuation and return:

With the most irrational exuberance having passed away in 2022, the markets are now, thankfully, rewarding intelligent investing again.

In the years ahead, an awareness of the history of booms and busts, along with an understanding of how long-term cycles of credit and debt impact the economy and markets, will likely prove particularly important while navigating the markets. This awareness informs all we do for clients at Sitka Pacific.

* * *

If you would like to move forward with a more resilient investment portfolio that invests intelligently, visit Getting Started. We would be happy to work with you to develop and implement a more resilient, all-weather investment management plan.

Sincerely,

Brian McAuley

Founder and Principal Advisor

Sitka Pacific Capital Management, LLC

Investment Advisors and Wealth Managers

If you would like to incorporate an absolute return SMA strategy to the range of investment options available to your clients, contact us for more information. We look forward to helping you and your clients achieve their goals with better risk-adjusted returns that are less correlated to the markets.

Sitka Pacific is listed in the InformaIS PSN database in the Global/International Balanced category.

Read a Selection of Recent Memos, Articles, and Client Letters

The content of this memo is provided as general information only and is not intended to provide investment or other advice. This material is not to be construed as a recommendation or solicitation to buy or sell any security, financial product, instrument or to participate in any particular trading strategy. Sitka Pacific Capital Management provides investment advice solely through the management of its client accounts. This copyrighted memo may not be copied, reproduced, republished, or posted, in whole or in part, without prior written consent from Sitka Pacific Capital Management, LLC.

Intelligent Investing Finally Returned in 2022

April 2023 Memo

Every crisis features human actors, and they always seem to step on the same rakes. They overlend and they overborrow; they get bullish at the top, and then, wouldn’t you know it, they get bearish at the bottom. The longer I live, the more I see that human beings have no business dealing with money. They are genetically unequipped for it, and it’s a wonder that anybody’s solvent.

Then again, no two crises are exactly the same. Except for the differences, after all, the historians would have all the money…

~ Jim Grant, of Grant’s Interest Rate Observer, April 16, 2009

For those of us with an inclination toward understanding current events through the lens of history, periods of irrational exuberance represent a special challenge.

On the one hand, periods of irrational exuberance have occurred so often throughout history, with such fascinating similarity, that they naturally make market historians pre-disposed toward skepticism. This skepticism flows from a keen awareness of the tremendous impact of the inevitable fallout once the exuberance comes to an end.

Yet on the other hand, history often rhymes, but it does not repeat. This makes navigating the aftermath of a period of irrational exuberance an existential challenge, because each period is unique. As investors, we must respond to market trends as they actually unfold – not as history says they should unfold.

Where an awareness of history comes in most handy is in understanding the features of booms and busts which nearly all periods of speculative fervor share. This can provide an awareness that it most likely is not different this time, while also helping avoid critical errors that are made when it is assumed contemporary events will play out just as the past did.

The following charts highlight what the global equity market landscape looked like in 2021 and 2022, which will live in infamy as one of the most exuberant market environments in history.

The chart above shows that the value of the Wilshire 5000 Index reached 195% of Gross Domestic Product (GDP) in late 2021, just before the market turned down in 2022. This unprecedented valuation in 2021 left stocks in the U.S. valued at close to twice the size of the economy, and it was 42% higher than in 2000, at the peak of the Tech Bubble.

As I discussed in letters and articles throughout 2021 and 2022, the market environment leading up to that peak valuation was as exuberant as any other period in history. The next chart highlights that exuberance in action.

Each dot below represents one global equity market, except the U.S. market is broken down into two separate dots representing small-cap and large-stocks; those two dots are furthermost on the right of the chart, which indicates that small and large-cap stocks were alone in being severely overvalued in 2021.

The rest of the world’s equity markets are clustered on the left side of the chart, to the right and left of “0%” on the horizontal axis. This indicates markets outside the U.S. were, as a group, fairly valued to begin 2021.

The upward sloping dashed regression line shows that the more overvalued a market was in early 2021, the higher return it provided over the subsequent year. And the more undervalued a market was, the lower its return tended to be in 2021.

This behavior is the opposite of what is generally expected by intelligent investing, as the grandfather of value investing Benjamin Graham outlined it. The central idea when looking at market prices from an intelligent, value perspective is that the lower the valuation of an investment, the higher the subsequent return will be.

Yet in 2021, and the years leading up to 2021, the opposite was the case. In those years, there was a positive correlation between valuation and return. In other words, the higher the valuation climbed, the higher the subsequent return.

Then in 2022, it all changed, and the markets finally began to act more intelligently: overvalued equity markets began to decline, and undervalued equity markets generally maintained their valuation, or increased value, as one would expect:

The return of intelligent investing in 2022 reversed the relationship between valuation and subsequent returns from what it had been in prior years. This can be seen in the chart below, with the dashed regression line between valuation and subsequent return sloping strongly downward in 2022. This reflects the expected long-term relationship between valuation and return:

With the most irrational exuberance having passed away in 2022, the markets are now, thankfully, rewarding intelligent investing again.

In the years ahead, an awareness of the history of booms and busts, along with an understanding of how long-term cycles of credit and debt impact the economy and markets, will likely prove particularly important while navigating the markets. This awareness informs all we do for clients at Sitka Pacific.

* * *

If you would like to move forward with a more resilient investment portfolio that invests intelligently, visit Getting Started. We would be happy to work with you to develop and implement a more resilient, all-weather investment management plan.

Sincerely,

Brian McAuley

Founder and Principal Advisor

Sitka Pacific Capital Management, LLC

Investment Advisors and Wealth Managers

If you would like to incorporate an absolute return SMA strategy to the range of investment options available to your clients, contact us for more information. We look forward to helping you and your clients achieve their goals with better risk-adjusted returns that are less correlated to the markets.

Sitka Pacific is listed in the InformaIS PSN database in the Global/International Balanced category.

Read a Selection of Recent Memos, Articles, and Client Letters

The content of this memo is provided as general information only and is not intended to provide investment or other advice. This material is not to be construed as a recommendation or solicitation to buy or sell any security, financial product, instrument or to participate in any particular trading strategy. Sitka Pacific Capital Management provides investment advice solely through the management of its client accounts. This copyrighted memo may not be copied, reproduced, republished, or posted, in whole or in part, without prior written consent from Sitka Pacific Capital Management, LLC.

Investment Management

Before investing, we will discuss your goals and risk tolerances with you to see if a separately managed account at Sitka Pacific would be a good fit. To contact us for a free consultation, visit Getting Started.

Macro Value Monitor

To read a selection of recent client letters and be alerted when new letters are posted to our public site, visit Recent Client Letters.